We all know what it can feel like to hear there isn’t budget for our project. Paul Sansom, Business Consultant at Vendavo, has your breakdown of the strategies you need to overcome this hurdle and ensure your project gets the funding it needs.

One of the trickiest parts of process improvement projects is securing the funding to get started. You know how important that project will be to operations and your bottom line, so how do you get key stakeholders and decision-makers on the same wavelength?

First things first, let’s talk about the costs of not moving forward with your project. You had a reason for considering a shift in pricing optimization (or that of other software), so it’s essential to highlight what’s at stake if nothing changes.

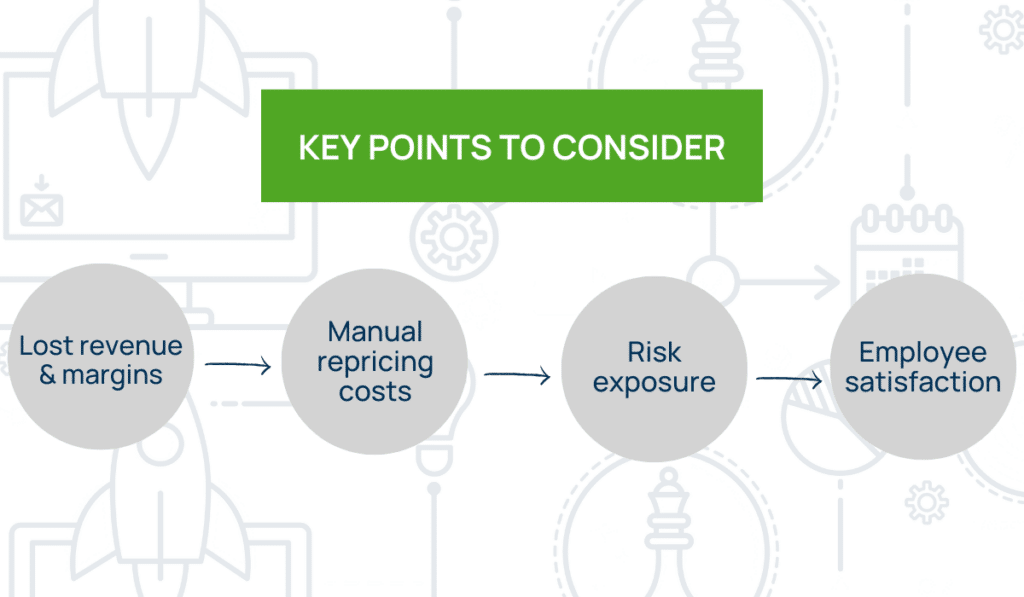

Here are some key points to consider:

- Lost revenue and margins – How many quotes are slipping through the cracks because of a slow quote-to-cash process?

- Manual repricing costs – What are you spending on manual repricing efforts and rebate management?

- Risk exposure – Does your manual quoting process leave you vulnerable to risks due to poor approval processes or outdated customer information?

- Employee satisfaction – How much longer can your team handle these tedious tasks before they start looking for other jobs?

Recognizing these hidden costs can make a compelling case for why your project is necessary.

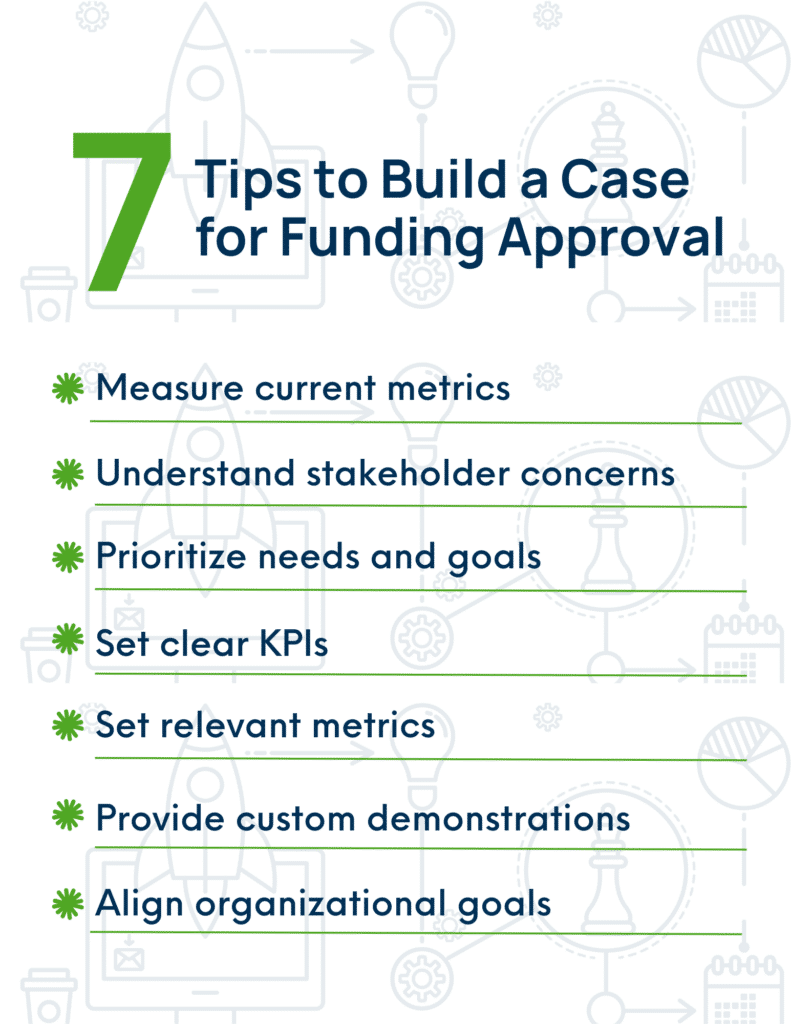

Building a Solid Business Case to Get Funding Approval

Securing funding for your project requires a compelling business case that clearly demonstrates the value and necessity of your initiative. By meticulously documenting your current processes, prioritizing your needs and goals, and setting clear performance indicators, you can build a persuasive argument that resonates with stakeholders.

Let’s break down the essential steps to create a rock-solid business case that will get your project the green light:

- Measure current metrics

Start by documenting the current state of your processes. How long does it take to create and approve quotes? How many hours are spent on manual repricing? What’s the error rate?

- Understand stakeholder concerns

Identify the primary concerns and objectives of each stakeholder group and address them directly in your pitch.

- Prioritize needs and goals

Identify what’s critical now versus what can wait. Consider factors like implementation time, overall cost, and scalability.

- Set clear KPIs

Define key performance indicators to track your progress. These might include ROI, margin improvement, quote efficiency, and more.

- Set relevant metrics

Tailor the metrics and KPIs you present to align with what matters most to each type of project.

- Provide custom demonstrations

Offer tailored demos that show how the solution will address the specific challenges and goals of each project type.

- Align with organizational goals

Ensure that your approach aligns with the broader strategic goals of the organization, such as growth, efficiency, or compliance.

It’s important to remember that B2B pricing improvement is not a project. With a solid business case in hand, it’s time to tackle the common challenges that often arise when seeking project funding.

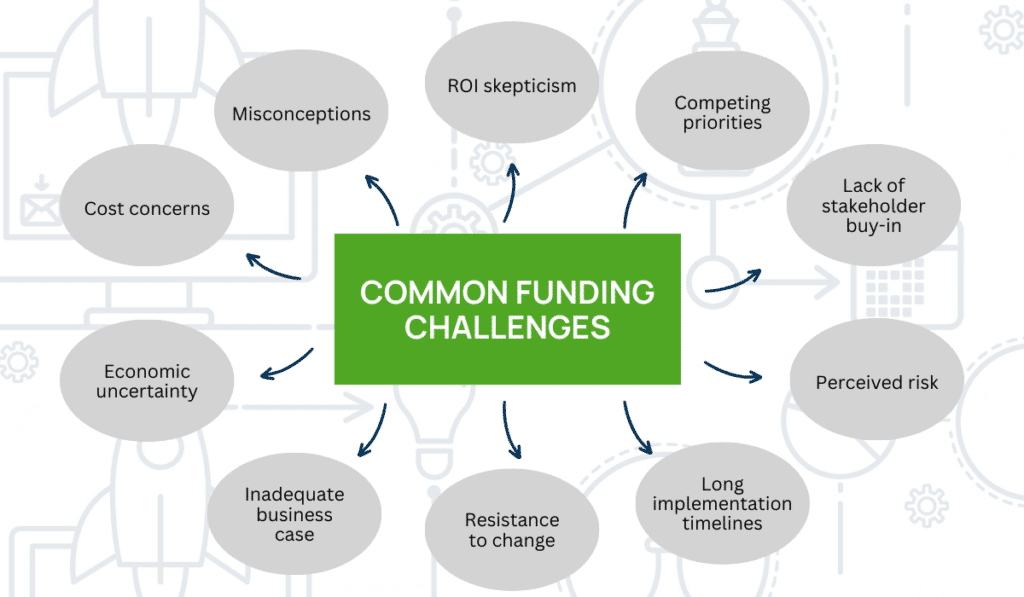

How to Tackle Common Funding Challenges

Every project faces hurdles when it comes to securing funding, but understanding and addressing these challenges head-on can make all the difference.

Let’s explore how to tackle these funding challenges with confidence.

- Cost concerns – Address cost worries by documenting the risks and opportunity costs of not moving forward.

- Misconceptions – Many think they can build a solution internally for less. Highlight the reality that IT teams are often too stretched to handle such projects effectively.

- ROI skepticism – Show that pricing projects often bring substantial returns, sometimes as high as 7-8% on sales. Conservative estimates alleviate skepticism. At Vendavo, we’ve created tools like a Pricing ROI Calculator to help you estimate the returns for your team. You can also work with our business consultants to build a stronger business case.

- Competing priorities – Other projects or initiatives may be prioritized higher, leading to limited available budget or resources for your project. To gain funding, align with strategic goals, demonstrate the potential ROI, highlight opportunity costs – particularly those of inaction, and be flexible and adaptable through continuous reassessment.

- Lack of stakeholder buy-in – You need the support and advocacy of key stakeholders to push a project through the approval process. Identify key stakeholders, communicate with them clearly and early, build relationships, demonstrate value, tailor your messaging, involve stakeholders in the process, provide training and resources, and monitor and adapt to encourage buy-in.

- Perceived risk – Concerns about the potential risks associated with the project can deter funding. Combat this with a thorough risk assessment to help you develop a management plan. Quantify and compare risks, implement pilot projects to test initiatives on a smaller scale, and focus on both long-term benefits and building a risk-aware culture.

- Long implementation timelines – Projects with extended timelines might be seen as too lengthy to deliver immediate value, causing hesitation in funding approval. Be sure to demonstrate how you will deliver value for the business at each phase of the rollout. Every milestone is an opportunity to report back to your organization.

- Resistance to change – Organizational inertia and resistance to change or adopting new systems can be a significant barrier to securing funding. You need to communicate, engage effectively, and address concerns directly. Offer comprehensive training for skill development, hands-on workshops to get everyone on the same page, and ongoing support. Focus on demonstrating and reinforce the benefits of the change so your team understands the perks of adoption.

- Inadequate business cases – Yours needs to be well-documented and align with your organization’s priorities and goals to gain approval. Luckily, we’ve developed a strong resource to help you build your business case.

- Economic uncertainty – External economic factors and uncertainty can lead to more conservative budgeting and reluctance to invest in new projects. In every business, the only constant is change. The key attribute that distinguishes a resilient organization from a failing one is agility. We pulled together some tips to build business agility so you can sustain profitability no matter what’s going on in the economy.

Successfully overcoming these challenges often depends on your ability to build strong relationships with your stakeholders. Engaging them early and often can significantly increase your chances of getting a project funded.

You can build those crucial relationships by:

- Understanding who will be using the new system and who will be affected by it

- Determining who controls the budget and what they care about

- Grouping stakeholders into champions, influencers, and blockers

- Tailoring your approach to each stakeholder group

- Clearly showing how the project will benefit stakeholders and make their jobs easier

Even with the best planning, there are always real-world challenges and frustrations to deal with. Your best bet is to anticipate issues ahead of time and come prepared with solutions.

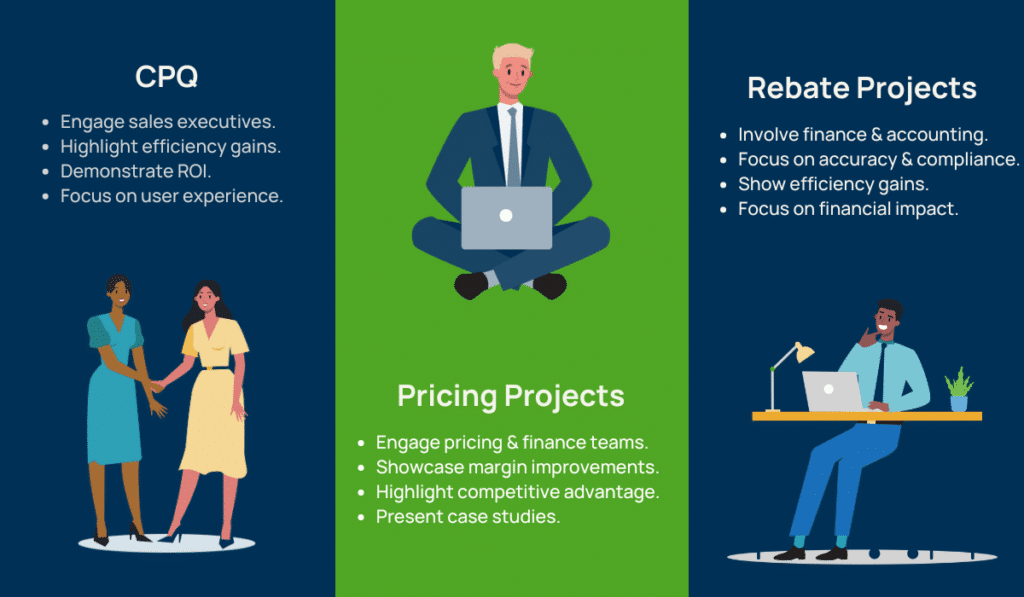

Tailoring Your Funding Approach to Different Projects

Not all projects are created equal, so your approach to securing funding shouldn’t be either. Different types of projects require tailored strategies to resonate with the specific needs and concerns of various stakeholders.

Here are some quick tips for how to customize your approach to align with the distinct goals and priorities of your organization’s diverse projects:

CPQ Projects

Your objective here is to streamline and automate the sales quoting process to increase efficiency and accuracy.

- Engage sales executives – Since CPQ projects directly impact the sales process, involve sales leaders early on to understand their pain points and requirements.

- Highlight efficiency gains – Emphasize how the CPQ system will reduce the time and errors associated with manual quoting, leading to faster quote generation and approval.

- Demonstrate ROI – Show the potential for increased sales productivity and higher win rates, which can directly translate to revenue growth.

- Focus on user experience – Illustrate how the CPQ system will make it easier for sales reps to configure complex products and generate accurate quotes quickly.

Learn more about CPQ implementation

Pricing Projects

Focus on cost improvements and efficiency gains, appealing to pricing executives. The objective is to optimize pricing strategies to improve margins and competitiveness.

- Engage pricing and finance teams – Work closely with pricing analysts and finance executives who are responsible for setting and managing prices.

- Showcase margin improvements – Provide data on how optimized pricing can lead to significant margin improvements and overall profitability.

- Highlight competitive advantage – Explain how dynamic pricing strategies can help the organization stay competitive in the market.

- Present case studies – Share success stories from similar companies that have implemented pricing optimization solutions and seen substantial benefits.

Learn more about pricing software implementation

Rebate Projects

Your objective here is to automate and streamline rebate management processes to ensure accuracy and efficiency. Highlight the benefits to appeal to financial executives.

- Involve finance and accounting – Engage with finance and accounting departments that handle rebates and accruals.

- Emphasize accuracy and compliance – Highlight how the solution can reduce errors in rebate calculations and ensure compliance with financial regulations.

- Show efficiency gains – Demonstrate how automating rebate management can save time and reduce administrative burden, allowing teams to focus on more strategic tasks.

- Focus on financial impact – Provide examples of how accurate rebate management can improve financial forecasting and budgeting.

Learn more about rebate program implementation

Securing project funding might seem daunting, but it’s entirely achievable with a strategic approach. Remember to document your current processes, prioritize your goals, set clear KPIs, and build strong relationships with your stakeholders.

Preparation, clear communication, and demonstrating tangible value are key to making your case compelling and successful.

Ready to take your organization’s growth and profitability to the next level? Reach out today to speak with a Vendavo expert about how our full suite of commercial excellence and revenue optimization solutions can help.