Producer/wholesale prices (PPI) have been on the decline for several months, but what does that mean in terms of inflation and margins? This article by Dan Cakora, Business Consultant at Vendavo, covers what you need to know about the trends we’re seeing and what they mean for the bigger picture.

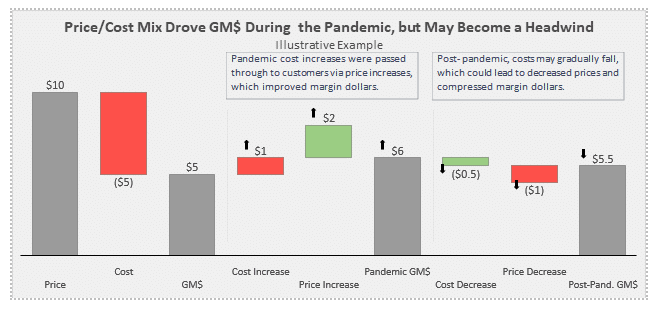

Businesses are abuzz with news that producer/wholesale prices (PPI) have continued to decline with just a 0.1% increase in June 2023 after three consecutive months of significant declines. This is a stark contrast to the frequent, large increases seen in early 2020. Many organizations enjoyed carte blanche price increases throughout the COVID-19 pandemic. Are they beginning to see the need for lower prices is inflation slows? The fear is that lower inflation will translate to lower margins, a hit any business is reluctant to take.

Customers, who have had to either grin-and-bear double-digit price increases or do without necessary goods and services, will expect suppliers to decrease their prices.

Is it time for manufacturers and distributors to slash prices? Is the long-awaited margin compression reckoning upon us? Rather than speculate, let’s look at the data to determine where we stand today, and see where we might be headed.

Producer Price Index

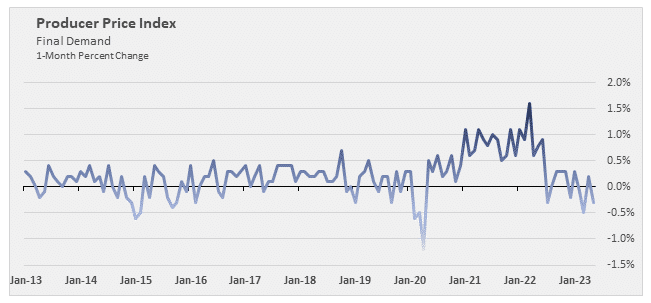

In the PPI, any month above the 0% line indicates prices got more expensive, and any month that is below the 0% line means that prices became cheaper. PPI was negative in December 2022 (-0.2%), February 2023 (-0.1%), and March 2023 (-0.5%), and May 2023 (-0.3%) which means that goods and services became slightly cheaper compared to the prior month. Three out of the last four months have shown decreases, so analysts think that these reductions could signal the end of the vast inflationary period that began early in the pandemic.

Since 2013, 70.4% of months have seen a price increase from the prior month, with 24% showing a price decrease, and 5.6% remaining flat. Put another way, the general trend has been gradual price increases over time, which happens to correspond to one of the Federal Reserve’s mandates of low and stable inflation. Moreover, in the date range presented above, there have been ten instances of consecutive month-to-month price declines.

I recommend taking a wait-and-see approach before acting, unless your hand is forced. Historical data indicates that it’s most likely to see a mix of monthly increases and decreases rather than a freefall in price. PPI may bounce around close to zero, which indicates minimal price increases or decreases. Why preemptively write down your prices if inflation goes flat?

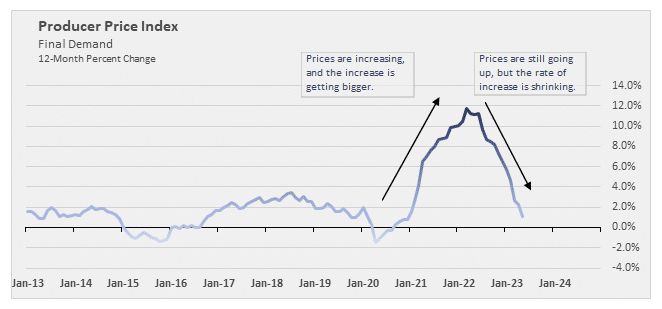

Given the volatility of month-to-month data, it’s helpful to review the data 12-month percent change (i.e. year-over-year price change) because the volatility is smoothed and trends are easier to detect.

Prices jumped significantly beginning in early 2020, with the YoY increase reaching its peak in March 2022 (+11.7%). Since the peak, the rate of price increase has slowed, but to be clear prices are still increasing overall (+1.1% in May 2023 vs. May 2022).

When taken together, we have not yet seen true deflation on an aggregate level, although this 12-month view is inherently a lagging indicator and could eventually catch up with the 1-month view presented earlier. Time will tell, so companies must maintain line-of-sight to inflation and the market so they can react accordingly.

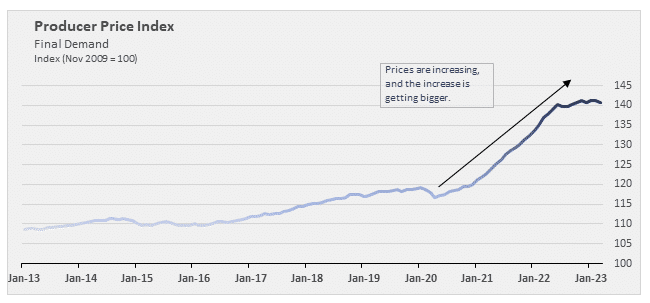

Before making any rash decisions, keep in mind that inflation increases are already “baked in” and will take time to unwind (if they ever do). Since 2020, prices are up ~17.8% on an aggregate level so it will take sustained price decreases to get back to where we were pre-pandemic. To make this clearer, I’ve included a view of the PPI Final Demand data in an index view.

Let’s revisit the two questions asked at the outset of this post: Is it time for manufacturers and distributors to slash prices? Is the long-awaited margin compression reckoning upon us?

Based on the data we just reviewed, it appears that we’re not on thin ice, but we are certainly on ice. Inflation is slowing but is not yet deflationary. A deflationary environment could necessitate margin-crushing price decreases. Don’t sound the alarm yet but it’s time to begin preparations for a quick reversal.

5 actions to take if you need to lower prices

Dr. Tim Smith, an Instructor at DePaul University GSB, says it best: “I can price only as well as the stupidest competitor.” All the data in the world won’t help you if customers demand price relief and competitors provide it. If it’s time to lower prices, keep the following thoughts in mind to avoid being drawn into a price war.

- Employ the “Rocket and Feather” model.

Push cost increases through immediately, but delay decreases. On the way up, protect your margins. On the way down, pocket the difference between your higher price and newly lower cost, even if the gap is temporary. While you temporarily delay customer price decrease, demand immediate relief from your suppliers. That way, you are ahead of the game and have improved costs in place when price reductions need to be honored.

- Understand your competitors’ pricing.

If you do find that competitors are lowering prices, do your homework to verify. Which SKUs or product groups are being changed? By how much? If the breadth is narrow or the reduction is minimal, then perhaps a response is not warranted. However, if the reduction is large enough to warrant a response, then employ targeted decreases rather than across-the-board cuts.

- Conduct business that can’t be copied.

Consider the maturity of the industry and how your competitors may respond. Ideally a price decrease can be positioned as a moat that can’t be easily copied. For example, lower prices be driven by expanded inventory, investment in logistics, or greater efficiency, rather than a simple “cost down, price down” story.

- Engage in a tactical retreat.

Select a handful of non-core but visible products, reduce the price, and proactively let your customers know that you are working hard to deliver great products at an improved price. The marketing halo provided by the decrease should more than make up for the revenue and margin lost from the lower prices of non-core SKUs.

- Don’t compete on price.

Finally, attempt to compete on anything other than price. What other value can you bring to the table? Can you offer faster shipping, a competitive bundle, or a new service that will further differentiate you from the competition and take the emphasis off price?

In the end, businesses need to respond to market pressures, and markets can change quickly. Prudent companies should plan to respond deliberately to competitor price decreases rather than being taken by surprise.