Optimizing revenue is key to business success. In this article by Kamal Sabnani, explore the art of revenue optimization and its impact on business growth. From its origins in the airline industry to widespread adoption, discover how data-driven strategies boost revenue. Learn how revenue optimization applies to the retail and B2B sectors, with insights on pricing segmentation and effective price target setting.

Maximizing revenue is crucial for sustained success in today’s fiercely competitive business landscape. Organizations employ a wide range of strategies for revenue growth, including price optimization, market segmentation, up-selling, cross-selling, new product development, and expansion into new markets.

In this blog we will explore revenue optimization, a form of price optimization that is an organic strategy to stimulate revenue growth. We will first begin with what revenue optimization means, delve into its origins, examine its widespread adoption across various industries, and wrap it up by providing insights on how it can be effectively applied in the B2B space.

What is Revenue Optimization?

Revenue optimization, also known as “revenue management” or “yield management,” is the art and science of maximizing revenue and optimize profitability through data-driven strategies. It involves understanding customer behavior, market dynamics, and internal capabilities to make informed decisions about pricing, inventory allocation, and distribution.

At its core, revenue optimization strives to discover the optimal balance where the appropriate product or service is presented to the suitable customer at the right price and moment. Doing so unlocks every potential revenue opportunity, leading to increased revenues and enhanced business performance.

Origins of Revenue Optimization

The origins of revenue optimization can be traced to the airline industry in the 1970s and 1980s when the space predominantly relied on fixed pricing structures for their flights. The fares were typically set based on distance or zone-based pricing, with little consideration given to demand fluctuations or factors that could impact revenue generation.

This approach often led to missed revenue opportunities and suboptimal use of available resources. American Airlines, one of the leading airlines at the time, brought a revolutionary change in the industry by introducing the concept of dynamic pricing. By analyzing historical data and demand patterns, the company was able to conduct customer segmentation and optimize seat inventory and adjust its prices accordingly, leading to improved revenue outcomes.

This breakthrough inspired other industries facing similar challenges – such as hotels, car rentals, and cruise lines – to adopt revenue optimization techniques. It has since become a fundamental aspect of revenue management across many sectors.

Revenue Optimization in the Airline and Hotel Industries

One of the significant challenges faced by the airline and hotel industries revolves around the intricate task of time-based inventory allocation. This essentially means that products lose their value by a certain point of time – such as flight take off or day-of accommodations – and there is a limited capacity that cannot be expanded to accommodate higher demand. Any unoccupied seat or room not sold at a certain point represents a missed revenue opportunity.

While airlines or hotels have the option to offer vacant spaces at significantly discounted rates, they must exercise caution to avoid undermining their brand equity or encouraging consumers to habitually seek last-minute discounts. They tackle this challenge by deploying forecasting and dynamic pricing algorithms to predict demand and estimate price elasticity based on several factors, such as:

- Historical booking trends

- Customer buying behavior

- Market conditions

- External events

- Weather

- Competitive pricing

- And more

This allows them to adjust pricing in real time to meet the goal of selling all available inventory at the best possible prices to optimize sales. They optimize their revenue potential by skillfully anticipating cancellations or changes in itineraries and strategically overbooking their existing inventory.

Revenue Optimization in Retail

When transitioning to the retail industry, the fundamental concepts of forecasting and gauging customer price sensitivity largely remain unchanged. It’s crucial to acknowledge that the nature of the products differs significantly, however.

Retail features a wide range of products with varying demand patterns that do not lose value by a certain point of time, but instead exhibit different shelf lives. Unlike airlines or hotels where the inventory level is fixed for a certain time and/or day, retail shows more flexibility in terms of managing inventory levels.

Effective inventory management is crucial for revenue optimization in retail. Overstocking can lead to increased carrying costs and potential markdowns, while understocking can result in lost sales and dissatisfied customers. Retailers run different forms of advertising campaigns to attract foot traffic in the store and, while they make lower margin on certain products, the primary objective is to drive the size of the overall basket. Understanding price elasticity for a product, store, market, or customer response to price is thus crucial to understand the impact of price on the overall demand.

Retail is a highly competitive space with many brands and stores vying for customers’ attention. Setting prices that are competitive while maximizing revenue requires careful analysis of market dynamics and competitor pricing strategies. Retailers deploy multiple regression models, commonly referred as “market response models,” to predict consumer response to diverse business drivers like distribution, pricing, promotions, advertising, seasonality, and shifts in competitive pricing. These predictive models provide retailers with valuable insights on how to strategically allocate their investments to drive revenue growth.

How B2C Revenue Optimization Differs from B2B Revenue Optimization

Now that we have reviewed the application of revenue optimization in B2C, let’s explore how it can be effectively applied in the B2B space.

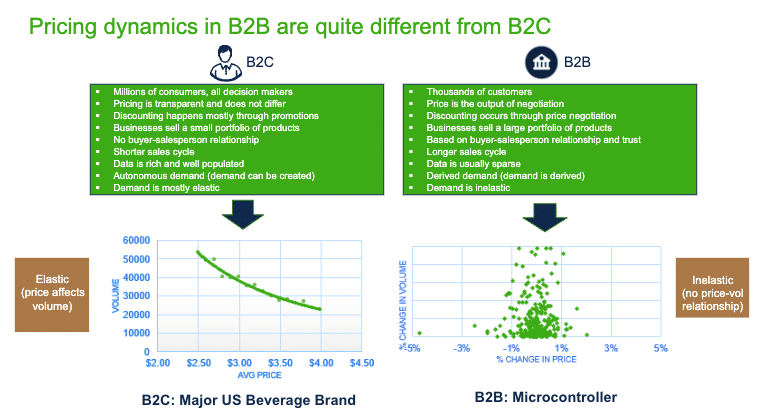

First let’s go over some of the key differences in the B2B space that make certain common pricing concepts inapplicable.

The primary distinction lies in the B2B pricing process, and that involves negotiations between the buyer and seller. Unlike B2C, where the buyer needs to offer the right price to attract specific consumers, B2B sellers need to estimate a suitable price range to initiate the sales process. These negotiations give B2B companies skin in the game, but it’s crucial for salespeople to grasp end customers’ identities, their willingness to pay, and competitive pricing pressure to ensure they are not leaving potential profits behind.

Another significant difference is the scope of the product portfolio. B2B companies offer a broader range of products compared to B2C, resulting in relatively sparse product data history.

Lastly, unlike B2C, demand in B2B is inelastic. Lowering the price of a product like headlights does not guarantee an increase in sales, for example. Sales are derived from and depend on the overall number of cars sold and other factors impacting the industry.

Revenue Optimization in B2B

Now, let’s explore a strategy that targets revenue optimization in the B2B sector.

Despite offering similar or identical products to different customers, pricing variation is inevitable in B2B. Interestingly, many may perceive pricing variation as an issue, but it proves quite useful in estimating customers’ willingness to pay. A pricer may feel confident about a specific price point, for example, but the reality is that sellers respond to both internal and external pressures in their quest to secure deals.

These pressures are heavily influenced by factors such as:

- Industry type

- Level of competition

- Potential substitutions

- Cannibalization

- Selling behavior

- Internal compliance measures

All of this is inherent in the actual prices that customers pay. The key decision for pricers is to decide on the right level of differentiation that helps us focus on relevant price variation and get better within those ranges.

So, how can we unravel the appropriate level of differentiation? A proven and effective approach in B2B is Pricing Segmentation, which involves analyzing transactional pricing history and classifying the transactions into distinct segments that exhibit similar pricing behavior. To conduct effective price segmentation, it is important to identify relevant product, customer, and transactional attributes that are:

1. Aligned with willingness to pay

2. Actionable within the business

3. Reliable in terms of data quality

4. Consistently maintained over time

Read Price Segmentation to Optimize Profitability for valuable insights and best practices on segmentation, the fundamentals of pricing segmentation, and various strategies for effective implementation.

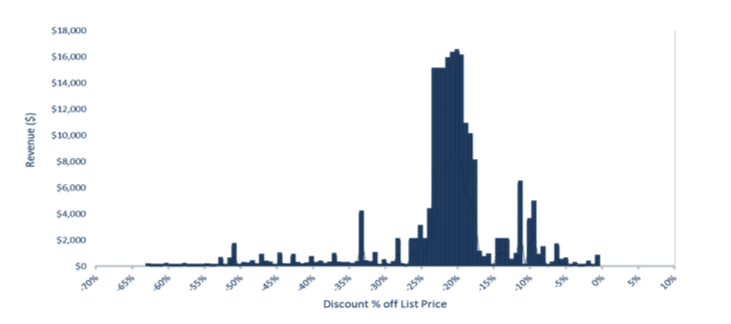

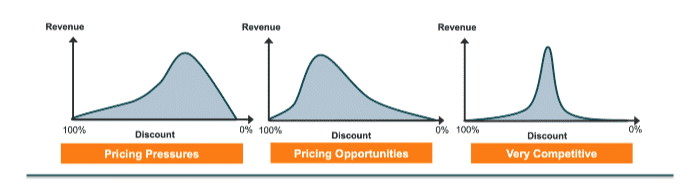

Once pricing segmentation is established, the next step is to set a price target in every segment. It’s important to note that underlying every segment is a price distribution that reflects underlying market realities and/or the effectiveness of pricing. At one end of the spectrum, we deal with tight and compact distributions with little room to adjust pricing. At the other end, we encounter wide distributions, some offering abundant pricing opportunities while others reflect pricing pressures.

Managing segment distribution is key to driving incremental revenue in B2B. Conducting a meticulous assessment of the distribution’s shape and underlying characteristics can help us categorize the segments into High, Moderate, and Low pricing opportunities. We can then set higher price targets for the segments with significant pricing opportunities, and lower targets for segments with limited pricing potential.

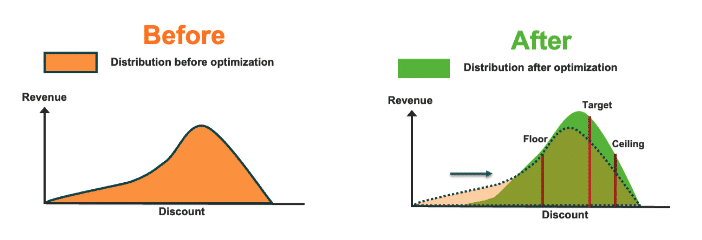

Setting a reasonable target for each segment means we can provide valuable guidance to the sales team on how they should price deals within that segment. These pricing recommendations are based on real data from previously priced deals within the segment, ensuring a more-informed approach rather than random guesswork.

While it would be ideal to hit the pricing target for every deal, realistically, not all deals can be pushed toward that target — especially if they are priced significantly lower. We can incorporate appropriate guardrails to address this and prevent excessive price increases, thereby avoiding potential sticker shocks for customers. The objective is to gradually steer customers toward the target price, allowing for a smoother transition.

With proper execution, this strategy can effectively shift distribution toward the desired direction, driving additional revenue for the business.

For an in-depth look at price optimization, check out Price Optimization: Why It’s Important and How it Works.

Explore Deal Price Optimizer, a product that empowers B2B companies to offer sales teams precise pricing guidance recommendations derived from customer’s willingness to pay.