There has never been a smarter time to make commercial intelligence a top priority for your business. The pandemic has forced a major shift to omnichannel commerce – with a much more significant role for digital channels.

These newer digital channels provide far richer data from which we can draw insights. Conveniently, there are now more ways than before to leverage that richer data. And lastly, we’re in an extremely challenging market environment where pricing and sales intelligence is needed more than ever.

This is Part 3 of a 3-part series on Key Market Trends Transforming Sales and Pricing in B2B

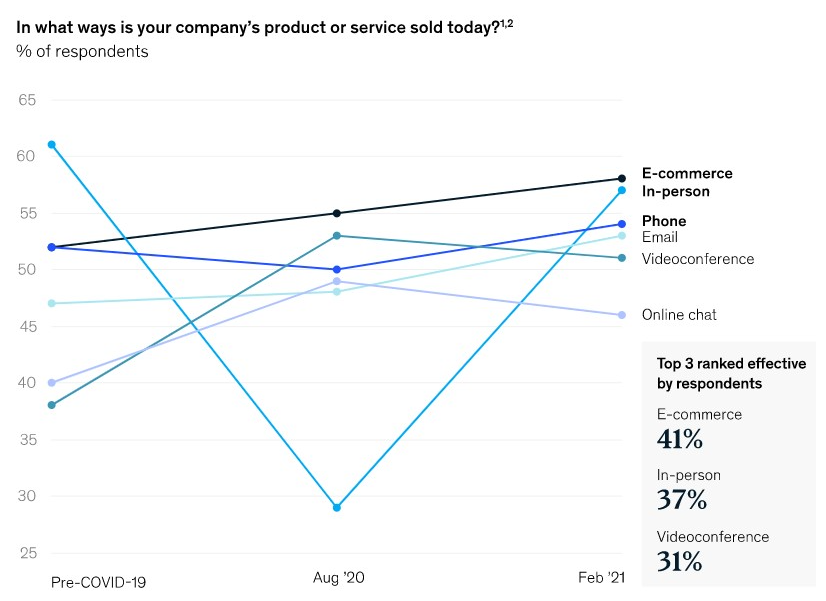

As we’ve noted in part one of our series, omnichannel selling and buying has become the predominant reality for B2B – with this shift getting a big boost from the COVID disruption, McKinsey points out:

Even as in-person engagement reemerged as an option, buyers made clear they prefer a cross-channel mix, choosing in-person, remote, and digital self-serve interactions in equal measure.”

The shift in the mix of interactions and sales channels towards digital and virtual means that more data than ever will be generated during the selling processes as well as the buying processes. Whereas in the past, when much of the interactions during selling and buying were not digital or virtual, events, decisions, reactions, counter-offers, et cetera were not reliably captured for use in data mining or advanced analytics.

More Ways to Use More Data

At the same time, the advanced analytics, AI, and ML that is often needed to leverage all this new and rich data has never been more accessible to business. More and more software providers are including advanced analytics capabilities within their purpose-built software – effectively helping their clients work smarter, not just more efficiently.

Then there are the data science and machine learning platforms like AWS SageMaker, Azure ML, and the Google Cloud AI Platform – platforms that enable organizations to build their own advanced analytics or data science solution quickly and easily. “Vendors that previously catered only to expert data scientists are adding augmented capabilities and improved interfaces to appeal to citizen data scientists,” Gartner explains. So in addition to there being more good data than ever before around the commercial processes in B2B, there are also more ways to mine and leverage that data for valuable insights than ever before.

A Bigger Need for Commercial Intelligence

Lastly, there’s never been a bigger need for sales and pricing intelligence due to the unprecedented market disruption caused by COVID, and now the very unequal recoveries that are underway. Usually, there is one or two key headlines in the business press being talked about and how it will impact what we should do.

But with COVID pandemic and resulting market disruption, we saw dramatic drops in demand in many markets, we saw the shutdowns and resulting imbalances in supply and demand create chaos in our precise and delicate supply chains, and we’ve even seen major shifts in the labor pools which is now hindering the recover in certain sectors.

We are now seeing inflation in several key areas:

Purchase prices for a range of products—from steel and copper to lumber and plastics—have gone up in recent weeks on the back of a resurgent U.S. economy. Bottlenecks around global production, supply chains and logistics are exacerbating the issue, resulting in shortages of key components such as computer chips…Company executives now have to decide how to offset these increases to protect margins and whether or not to pass the extra costs on to customers.”

These decisions often result in changes to commercial policies, negotiation terms, costs-to-serve, pricing approval levels or authorizations, and of course pricing guidance itself.

Even if companies raise prices that customers pay now, it takes time to recoup the increase in costs. Emerson Electric Co. , which sells tools and home products, as well as climate technology and automation services, is facing a $75 million headwind from inflation this year, CFO Frank Dellaquila said.

And these dynamics will not be consistent across the globe – there is strong evidence that the recovery from the COVID market disruption will be variable or unequal – with some companies and markets able to recover quickly while others are still battling pandemic challenges. So your adjustments need to be intelligent, market-specific, and delivered seamlessly to sales for execution.

In Summary?

In summary, the shift to digital commerce is creating massive amounts of new and useful data that’s just waiting to be leveraged. There are now more ways than ever to access this data and use it as commercial intelligence for determining and then implementing your commercial strategies and tactics.

And finally – there are an increasing number of market dynamics (like inflation) that will be critical to manage through the recoveries. So the need for commercial intelligence is present, but the data is there (or will be soon enough) and the means by which to leverage that data for insights is as well.