One of the most basic concepts of pricing is that price generally reflects (or should reflect) value. But it’s important to remember that value is not defined from the seller or supplier’s perspective – rather it’s defined by the customer or buyer. A certain product or service is only worth what a buyer is willing to pay for it. And their willingness to pay is based largely on how they perceive the value of the seller’s product, service or solution.

Also important to remember is different customers perceive value differently. Therefore, their willingness to pay is also different which means their pricing could be different too.

A simplistic approach is to understand what most customers typically value in your offering and then set prices based on what the estimated willingness to pay is for that product. However, in reality, different customers perceive value differently. Therefore, their willingness to pay is also different (and therefore their pricing could be different too). This strategy is valid in consumer products markets, but it’s fairly challenging to leverage because retailers often can’t discriminate on price from one consumer to another. But in B2B industries, it’s almost always possible and acceptable to differentiate price between customers because in many cases, prices are negotiated or established based on certain “fences” or boundaries (e.g. educational institutions get a different price than commercial businesses).

Two examples:

A manufacturer of truck tires once explained to me that some of his customers have different willingness to pay based on their industry. For instance, a fleet manager for a waste management business is typically very price sensitive so he’s not as interested in quality. If one of his trucks is disabled because of a blown tire, there would be no significant impact on his revenue. However, an oilfield services business who uses similar tires for their mobile drilling rigs, could lose a lot of revenue if one of their rigs (which they rent out by the hour or day) was out of commission due to mechanical or tire problems. Those two customers would likely have different price sensitivities and willingness to pay for an identical or very similar product.

A manufacturer of plastic pellets explained that even with her products, which are considered somewhat of a commodity by many, measurable differentiation in willingness to pay is driven by the end use application. For instance, when they sell plastic pellets for use in manufacturing pipe, the plastic is a relatively large percentage of the total cost of goods for the pipe. This pipe manufacturer is likely to have relatively high price sensitivity. However, when they sell the same or similar plastic to a company manufacturing a sophisticated and expensive medical device, that plastic is a relatively small portion of the cost of goods. So those customers tend to have a lower level of price sensitivity.

This principle is not new; it’s been in marketing and economic textbooks for decades. But this and other principles that explain differentiation in price are less commonly used in practice than you’d think.

In B2B, a company’s best sales people typically understand these dynamics intuitively and use them to maximize their commissions. But many times – especially in larger organizations – the bulk of the sales team ends up using a combination of recent experience (which may not be very relevant) and “gut feel”. Typically, they’re trying to optimize their chance of winning opportunities, not revenue or margins. So, it’s helpful to explain pricing segmentation to sales leaders as simply putting structure and logic in place that mimics how their best sales people already do things today. Indeed, at my employer, our projects always need to include the perspectives of the best sales people because they often provide some of the key context that either supports or clarifies findings from data and analytics.

Why Price Segmentation?

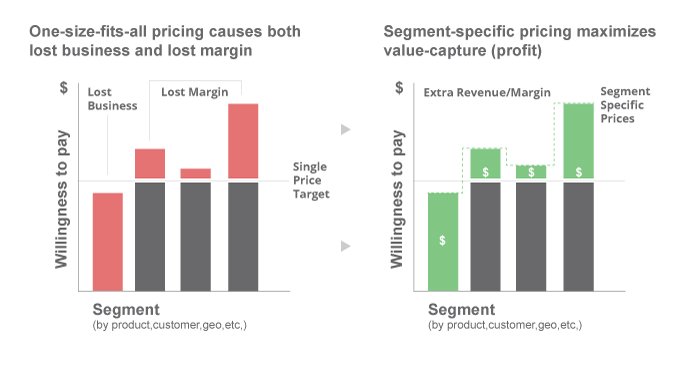

Why would you bother to differentiate prices based on customer willingness to pay? The answer is you stand to gain a LOT of value. If you have one price for a given market or region, you will be pricing too high for some customers and leaving money on the table for other customers. By pricing according to different customers’ willingness to pay levels, you can capture the maximum amount of revenue (which of course drives operating profit) for each deal or transaction.

In most cases these additional sources of value (revenue) come with little or no additional incremental costs, so there’s a direct – and large – link from that revenue to your operating profit. Moving to differentiated pricing based on pricing segments has been shown to generate anywhere from 1% to 6% of revenue lift (with virtually no incremental costs). That’s typically a 10% to 60% increase in operating profits.

How Do You Use Price Segmentation?

How do you go about discerning and then leveraging these pricing segments in the first place? Experience has shown that the best formula is a combination of data science, and business judgement and context. There are well-establish statistical methods for taking your company’s sales history and identifying pricing segments based on attributes of each sale.

These attributes tend to fall into three categories:

- Product / Service – attributes about what is being sold (e.g. Product Lifecycle, Unique or Competitive, etc.)

- Customer – attributes related to whom it is being sold (e.g. Customer Industry, Customer Size, New or Existing Customer, the End-use Application, etc.)

- Transaction – attributes related to the historical transaction itself (e.g. Spot Quote or Contract related transaction, Order Size, Competitor, etc.)

Once you leverage the attributes you already have in your sales history, you then need to factor in logical rules or strategies that may or may not be empirically present in the data.

A classic example is that you don’t want to group transactions sold directly with those sold through a distribution channel. Other insights are more nuanced and come from human interaction with the data – often your best sales people. This approach not only results in a more accurate segmentation, it also has benefits with regard to change management and adoption.

Finding the right level of segmentation is a bit of a “goldilocks” process: too much granularity and science in your segmentation and you will have way too many segments and they will be difficult to explain or understand. Too little granularity and you are just defining a managerial segmentation model (segments by rule), then you are most likely sub-optimizing your value by pricing too broadly.

You’ve Developed Price Segmentation. Now What?

Once your organization has agreed on a pricing segmentation model for your go-to-market approach, you then need to find a way to operationalize it. Merely defining it and articulating it to the right employees is not enough.

You need to provide segment-specific context and guidance to sales or price approvers in their day-to-day business process or context. This usually means delivering the segment-specific guidance directly into their CRM or CPQ environment where they are working on opportunities, quotes and contracts.

Read More: What is Intelligent CPQ and Why Should You Care?

Software vendors in this space are merging their capabilities, including Vendavo who now offers Intelligent CPQ, a cloud based packaged solution that allows you to maximize profit and win more deals with every quote through the joint offering of Vendavo CPQ Cloud and Vendavo Deal Price Optimizer.

Once you’ve set your segmentation and trained your appropriate teams on how to implement it, it’s time to sit back and reap the benefits. You’ll be glad you did.

Learn more about Vendavo Pricepoint and Vendavo Deal Price Optimizer.