My morning coffee just got more expensive at my favourite place – again. But, as the barista at my explained, it was the coffee bean prices that increased this time. Previously Brexit, tariffs, or bean bag shortages were to blame.

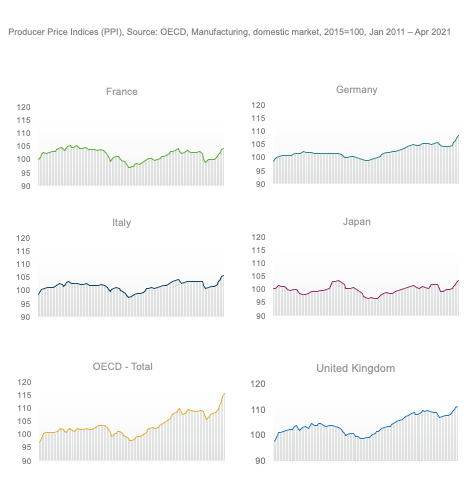

We see headlines from different industries and pundits about increasing prices. The reasons are various: supply chain disruptions, resource shortages, higher government spending, rebounding demand, and regional economic activity all contribute to input price increases. Nevertheless, the world is entering an inflationary environment not seen in more than 30 years. Recent macroeconomic data reveals a significant increase in producer price indices across all OECD countries.

Raw material price increases have been continuously beating consensus estimates since the beginning of 2021. From lumber to semiconductors, commodity prices were the first to experience an upward trend.

As an economist, I must note that central banks worldwide have been focused on a mandate of economic growth in the past ten years. As a result, price stability recently was not a subject of worry. Moreover, as economies are rebounding from a depression set off by the pandemic, monetary policy is likely to remain accommodative – allowing for higher prices – not to repress growth.

What Does Inflation Mean for B2B Companies?

In other words, elevated costs are here to stay. As a result, B2B companies are most likely to find themselves in volatile business environments – cost pressures in the short-term, rising interest rates to fight inflation in the mid-term.

Companies that solely pass on cost changes to their customers destroy shareholder value!

Raising prices at the rate of cost increases neglects the increased costs of financing working capital and future investments. In addition, historical analysis shows that companies, on average, have to grow their earnings at a rate double to inflation to maintain their fair value.

That is because objective valuation happens on future cash flows rather than earnings. As a result, cash flow erosion becomes real during inflation, and businesses must use their pricing power to increase prices faster than the rate of cost increases.

Next to cost increases, the pandemic caused significant demand shifts, directly impacting the margin mix. As a result, many companies now reveal margin pressures and face challenges to deliver their budgeted cash flows. Companies failing to adjust to this new reality risk their profits and face investor challenges on future value creation potential.

How Can Pricing Teams Mitigate the Impact of Inflation?

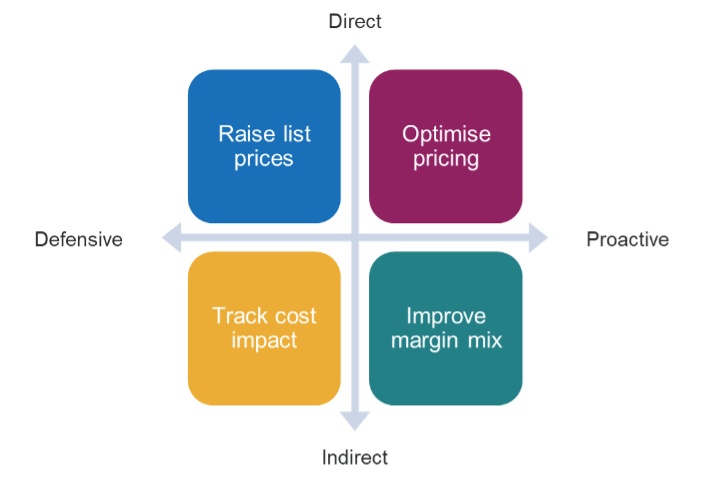

- Raise list prices – raising prices beyond cost can be challenging, especially when your contracts locked in customer prices for years. Simon-Kucher’s recent Global Pricing Study highlights that companies can only execute 1/3 of their list price increases. List or reference price changes help communicate the direction of price changes and partially blame cost increases. For example, published price lists on ecommerce sites help signal positioning and set the trend for competition to follow.

- Optimise pricing – do not expect sales to realise all reference price changes. Instead, provide them with guidance on where the company has pricing power and how to leverage it. Identifying microsegments where you can increase prices without losing volume is foundational to maintaining shareholder value. For long-term contracts, look to employ formula-link pricing methods to adjust for any cost volatility.

- Track cost impact – deploy margin-bridge analysis to understand whether you can increase prices faster than cost changes. Cost decompositions typically provide insight and arguments for sales battle cards.

- Improve margin mix – extend services offering, propose alternatives, increase cross-selling, use bundling to influence price sensitivity. In addition, incentivising and providing training to the sales team will be instrumental in achieving a higher profitability product mix.

Pricing Teams’ Arsenal to Combat Inflation

During inflationary times, it is a chance for pricing teams to shine and protect shareholder value. For me, that means accepting to pay more for my coffee and perhaps giving in to a cookie bundle occasionally.