My previous post focused on the disruption occurring in B2C retail and the impact it’s having on e-commerce B2B models. It also outlined some examples of companies that have made a comeback in the face of that disruption. Seemingly every week we hear a blend of failures and success stories within retail. Last week, Brookstone announced they filed for bankruptcy and will close all of their mall stores in the face of intense online competition. At the same time, Zara, Ikea and many other retailers are innovating their business models and leaving competitors behind.

In B2B, the pressure isn’t as intense as in B2C – that’s the good news. But we can’t deny that the force of disruption is real. From intense market commoditization to price transparency for standard products to the appearance of specialized marketplaces, B2B organizations generally and industrial distributors specifically must ask themselves some existential questions:

- How do we face disruption?

- How can we re-invent our business model in a way that means we will be in business 20 years from now?

- How do we leverage disruption and technology to create another level of competitive advantage?

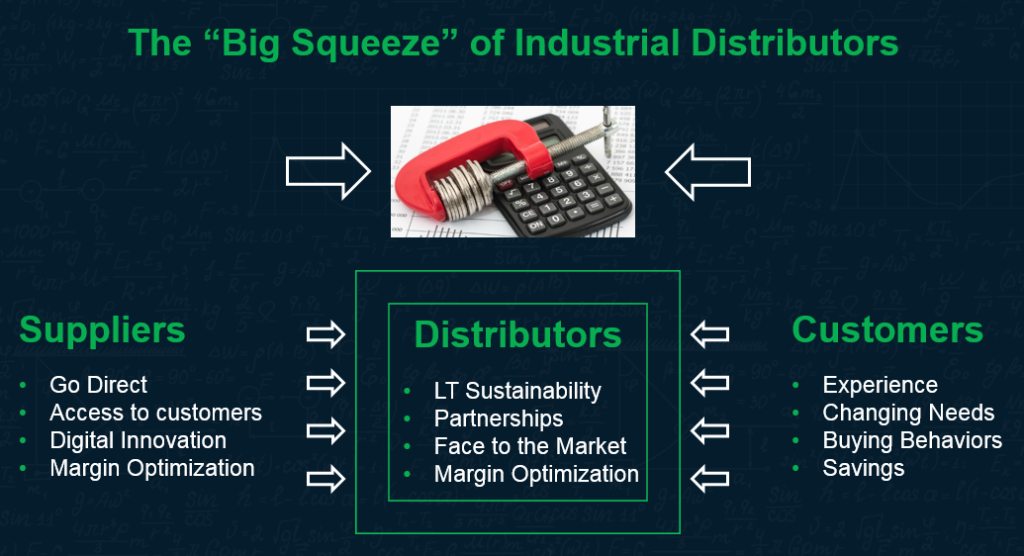

The good news again is there is still time to change and to take action. But the speed of change is accelerating. Distributors now face a real challenge as they are caught between large manufacturers who are challenging their business models and customers whose procurement behaviors are rapidly evolving. For years, manufacturers have entertained the idea of selling direct to end-users and/or open their own distribution network. With shrinking gross margins, accessible technology, and a need to manage the customer experience, more and more of these manufacturers are in fact moving some of their products online and managing some of the end-user relationship directly.

Customers’ procurement teams are also making large investments in procurement science, ordering through a variety of tools, and expecting year-on-year cost savings. The big squeeze is real. Distributors will no longer be able to compete on price alone or rely on support pricing from their manufacturing partners. They have to think more strategically and learn some of the lessons being taught by B2C retailers who managed to successfully re-invent themselves in the race against Amazon.

To improve the differentiation of the 21st century industrial distribution business model, there needs to be five areas of focus:

- Own the Customer Experience and Data. This principle has been a long-standing strength of distributors and it needs to be even stronger in the future. Through the A/B/C customer segmentation process, manufacturers have long delegated the management of small ‘non-strategic’ accounts to distributors. Distributors have an opportunity to emerge as the stronger player in understanding the customer experience, the changing procurement needs, and the mapping of data generated by thousands of end-users (including large A customers). That means having the right systems and skills in place to manage the data, understand customers, and connect the dots.

- Offer Unique and Inimitable. By forging strategic relationships with the right manufacturers, distributors can secure unique offerings and sometimes exclusivity for a region, a brand, or a line of products. Partnerships are working well in B2C retail to create such unique offerings. For example, Best Buy partnered first with Samsung and now Amazon. Besides products and technologies, inimitability can also happen in the area of service, spare parts, and maintenance. These are typically more profitable offers which have been neglected by some manufacturers.

- Create a Holistic, Hybrid Footprint. Distributors also have the chance to innovate in their designs of omni-channel distribution strategies. This has been a major area of investment for companies like Staples, Best Buy and Target. Customers don’t want to hear about lack of availability and long delivery times. They want appropriate product recommendations, guidelines on assortment and once they’ve decided, they want the product right away. For that reason, distributors must think strategically about supply chain and ecommerce.

- Rely on Real-time Analytics. Data is the new gold. Distributors have a unique opportunity to turn what they know about their customers into profit. Machine learning and artificial technology isn’t futuristic; it’s here now and distributors have the information, it just needs to be used. Grainger has demonstrated great leadership in this area with solid success; the same with Avnet.

- Choose a Customer-centric Marketplace. Whether you decide to join forces and create dedicated e-commerce marketplaces or you invest heavily in creating your own market place, you need an e-commerce strategy that includes thought about how to engage other partners in the process. You should also work to attract many other manufacturers to a distribution-led marketplace. Throwing up a website to sell your products is no longer enough. Marketplaces connect product and service providers as well as have the potential to gather additional data for future innovation.

To some of you, these are not new concepts. This has been done successfully by some of the best in class B2C retail companies and manufacturers as well. The real challenge for distributors is how to integrate these 5 components into a holistic business model and get business done. The issue remains execution. You’re good at supply chain, procurement, and managing lots of end-users. Can you build on these foundations and add differentiation in partnerships, customer experience, dynamic pricing, technology, and data analytics?

There is still time to get started. Start with a strategic discussion in the C-suite and the design of a robust action plan. Amazon, Google, Alibaba are at the gate. It’s time to self-disrupt before you get disrupted.

If you’re responsible for the profitability of your distribution business and you are feeling the pressure from inside and outside your organization, join Stephan Liozu and Vendavo for the Distribution Disruption Forum on October 30 in Chicago.