Rebates are financial incentives provided by sellers to buyers for achieving pre-specified purchase or performance goals, but how can you make your rebate strategy as effective as possible? This article by Israel Rodrigo, Business Consultant at Vendavo, explores when to use a rebate strategy, how an effective one can positively impact business, the challenges you might encounter while rolling one out, and the best practices to make your organization’s rebate strategy as effective as possible.

If you’ve been in business for a while, you’ve likely heard of rebates. Price rebates are financial incentives provided by sellers (manufacturers, distributors, or retailers) to buyers (distributors, end customers, or consumers) for achieving specified purchase or performance goals. These goals can be based on factors such as volume purchases, loyalty, or meeting predetermined sales targets.

Rebate optimization focuses on the strategic management and analysis of rebate programs to maximize their effectiveness and impact on a company’s financial performance. 56% of manufacturers and distributors implement rebate/incentive programs as a top financial strategy. Properly managed and optimized rebate programs can drive 2% to 10% incremental sales, plus have a significant impact on profitability and customer satisfaction.

You might be wondering, isn’t that what discounts achieve as well? Yes, rebates and discounts are both pricing strategies to incentivize customers, but they differ in their application, timing, and the way customers receive the benefit:

- Discounts are immediate reductions applied at the time of purchase, visible to customers during the on-invoice transaction, and immediately impact financial cash flow.

- In contrast, rebate management involves a delay in benefit where customers pay the full price upfront and receive a partial refund or credit after satisfying a condition, such as submitting proof of purchase.

While rebates are perhaps one of the most valuable commercial tactics across various industries, their usage is not widespread. This article explores when to use a rebate strategy, how an effective one can positively impact business, the challenges you might encounter while rolling one out, and the best practices to make your organization’s rebate strategy as effective as possible.

Why Use a Rebate Strategy?

Pricing optimization typically refers to optimizing a negotiated contract price in the form of a discount off list or a net price. There are volume-based or tier pricing policies, and each has benefits.

Rebate optimization takes that concept further since it can help shift part of the benefit given in exchange for a promise to a more compliance-based agreement, where the customer has to claim it.

The choice between discounts or rebates will depend on factors like the desired timing of customer benefit, transparency, administrative complexity, and the business’s long-term strategy, but the benefits of effectively executing rebate programs far surpasses discount-based policies.

Some of the benefits of an effective rebate program include:

- Promote customer loyalty

Rewarding good customers with rebates encourages them to stick and repeat purchases. It can also provide a competitive advantage by attracting new customers while retaining existing ones. - Increased revenues

Rebates increase sales without forcing the seller to drop their price. Targeted, well-designed rebate programs can incentivize higher purchase volumes by promoting certain products, improving the mix, preventing price erosion (price masking), optimizing inventory, discouraging over-promising, gamesmanship, and entering new markets.

- Improved operating margins & cash flow

Rebate optimization can lead to better inventory management, operations, and profit improvement. Discounts can boost immediate sales but reduce the amount of cash received per sale. Rebates generally have a deferred impact on revenues since the company receives the sales upfront and the obligation to pay the rebate happens later (becoming a liability to be managed).

- Align business strategy with data-Driven decision-making

Rebate optimization involves analyzing data to properly segment the customer base, align their willingness to pay, design the right rebate program and structure, track performance, and ensure incentives remain effective and relevant.

Discounts are straightforward and universally applied, but rebates offer more customization, may require greater communication effort, and have a higher risk of misuse if not monitored.

Challenges in Rebate Management

Managing rebate and incentive programs requires more complex administration than offering list price discounts. We need to develop targeted strategies to customers based on behaviors or segments, thereby accruing and deferring the impact on cash flow.

- Data management

Rebate programs rely heavily on data, including customer rostering, affiliation, purchase history, sales data, and performance metrics. Communicating rebate program details, eligibility criteria, and changes effectively to customers can be challenging. Ensuring data protection regulation of customer sensitive data, accuracy, quality, data security and integration with various systems is essential. - Program design complexity

Rebates increase the complexity of pricing processes, adding administrative costs and variability to the negotiation. Designing and managing programs that offer the right incentives to the right customers at the right time requires a solid understanding of customer behavior and market dynamics. Incentive programs typically involve multiple designs, tiers, eligibility criteria, and performance metrics. - Accrual calculation and payment

Rebate programs require accurate accrual calculations, since they are a combination of variables such as sales volume, product families, bundles, and customer segments. Mistakes in calculation can lead to overpayments, customer claims, or accounting errors, which can be costly. - Claim resolution

Disputes can arise when customers and channel partners submit proof of purchases that don’t align with the rebates they’re entitled to. Resolving these claims is typically manually or offline, requiring clear documentation and efficient communication. - Program effectiveness & compliance monitoring

Ensuring that customers adhere to the terms and conditions of rebate programs is a significant challenge. You need proper monitoring and compliance management, or customers could miss out on rebates they are entitled to. Poorly managed rebate programs can erode profits and lead to financial losses.

You don’t need to tackle rebate strategy alone, however. The right experts can make sure yours is the right fit for your organization and set up as effectively as possible.

Best Practices & Strategies for Rebate Optimization

Data Management: Data-Driven Decision-Making

One of the foundational aspects of rebate optimization is its heavy reliance on data. From a program definition to accrual generation, claim reconciliation, and payouts, having a common data model across the commercial policies and definitions of customer, products, and sales organizations is key to success.

Organizations need to ensure these hierarchies persist across list price setting, discounting, and rebate management. This will ensure consistency and end-to-end visibility, enabling data-driven decision-making. Commercial analytics and pricing optimization solutions can then provide actionable insights into customer behavior and willingness to pay.

Through system integration, these solutions provide priceless information about the sensitivity that customers have from gross to net prices while combining different strategies to maximize profitability. This includes:

- Encouraging collaboration between sales, channel partners, finance, and other relevant stakeholders by centralizing data and providing user-friendly interfaces for different stakeholders to access and contribute information

- Considering dynamic pricing strategies that adjust rebate structures in real-time based on customer behavior and market conditions. This can help you capture more value from customers who are willing to pay while offering discounts to price-sensitive ones.

- Implementing a value-based pricing strategy that aligns your rebate structures with your products’ or services’ perceived value, or helps you assess your competitors’ rebate programs. This can help you identify opportunities to differentiate your offerings.

Program Design: The Right Rebate Program

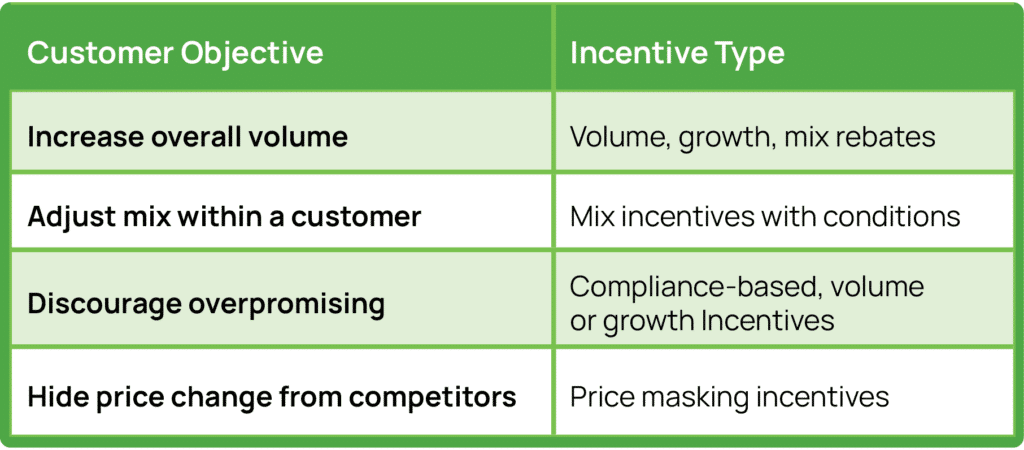

You can incentivize desired behavior with the appropriate rebate type. You need to define your strategy and align clear objectives before designing a rebate program.

Here are some things to keep in mind:

- Understand the concept of willingness to pay or price optimization, which is the maximum price a customer is willing to pay for a product or service.

- Not all customers are the same, so one-size-fits-all rebate programs are often less effective.

- Segment your customers based on criteria such as class of trade, channel, buying behavior, geography, or product preferences.

- Then, analyze their behaviors, preferences, and past purchase histories to identify patterns.

- This can help you tailor rebate structures to different groups and set the right rebate levels.

You can use rebates to cater to customer willingness to pay and incentivize behaviors that align with your business objectives. Offer them to customers who make larger purchases, buy bundled products, or commit to long-term contracts, for example. High-value customers may receive more generous rebates, while price-sensitive customers might get smaller discounts. Some might look for a tiered structure with increasing levels of discounts as they achieve higher purchase volumes, while others may want to maximize their rebate checks or their rebate programs’ year over year growth.

Creating a set of segmented incentive templates will help you reduce complexity, ensure the right incentive is applied to the right customer objective, and serve as your “rebates playbook.” This is a strategic process that means you must meticulously design incentives, set clear performance metrics, and maintain a commitment to transparency and improvement.

Automation of Rebate Calculations

Managing execution is one of the most complex areas of rebate optimization. Administrating customer incentives is one reason why organizations struggle to develop these strategies effectively or only partially succeed at them.

To effectively manage rebates:

- Rebate accruals need to be accurately calculated at scale based on parameters such as transactional sales volume, product, customer segments, ship to/sold to or channel, region, price list, and more.

- This level of granularity and precision ensures that accruals are booked accurately from an accounting and revenue recognition point of view

- This will be true regardless of how frequently your product portfolio changes.

- It will also be true regardless of program definitions or qualifiers, such as customer and product eligibility, price, quantities, or time validity.

- This reduces disputes and helps maintain customer trust.

B2B rebate management often involves integrating multiple systems and processes, from sales data to financial records. Vendavo’s automation capabilities streamline these processes, reducing manual work and the risk of errors. Integration with existing enterprise systems ensures that rebate management is seamless and efficient.

Vendavo helps ensure compliance by automating calculations and providing transparent documentation of rebate agreements. Being able to automate the calculation of rebate conditions, accruals, reconcile and settle claims, payments, and implement them downstream – in your ERP, CRM, and eCommerce portal, for example – is critical to ensuring the effectiveness of the program and eliminate margin leakage and accounting risks.

Claim Resolution

You can remove friction from the dispute process by providing a transparent and auditable system that accurately calculates rebates based on agreed-upon criteria. The platform’s reporting features provide clear documentation of the terms and conditions of rebate agreements. The system integration with data sources such as EDI and systems such as ERP, CRM, and eCommerce/partner portals, enabling centralized claim management. It also has the ability to bring in deductions from financials and reconciliation of payments between suppliers, customers, and distributors, where they can submit point-of-sale data, review claim status, and download rebate backups and remittances. This reduces the likelihood of disputes and facilitates quick resolution when they do occur. This helps with rebate program rules and regulations, and is crucial to minimizing claims and maintaining customer trust.

Program Effectiveness & Compliance

Your product portfolio, market conditions, and customers’ preferences change over time. Commercial policy definitions such as list prices, negotiated discounts, or managing customer profitability are ongoing processes, as is rebate optimization. You must continuously monitor the effectiveness of your rebate programs, then analyze the data to derive insights and trends and modify as needed. Integration of rebate impact into the gross-to-net customer waterfall is key to ensuring adherence to contractual terms.

Vendavo offers real-time visibility into rebate program performance. Robust analytics solutions such as Margin Bridge Analyzer allows you to assess your rebate program’s impact on customer behavior and overall revenue. Defining control groups through A/B testing can also help you tweak the rebate framework to maximize its effectiveness, making this process more manageable.

Rebates Are Key to Business Success

Rebate optimization is a critical component of commercial excellence in pricing. Mastering rebate optimization is a key differentiator as the business landscape continues to evolve and with the increasing needs to enforce contractual compliance. This helps your organization achieve sustainable growth and profitability.

In the end, it’s not just about providing rebates, but about doing so intelligently and strategically. The right technology and commercial vision can make rebates work for your business and your customers, ensuring that both parties benefit from this powerful tool in the world of commerce.

Reach out to an expert today to request a demo and discuss how the right rebate strategy can help your organization reach its revenue goals.