Pricing Optimization is a capability that is finally making its way into the mainstream for companies in all industries. The term price optimization deserves some definition though, as buzzwords can confuse rather than clarify understanding. Pricing optimization broadly refers to approaches for setting the optimal list or target prices to achieve a certain objective or goal, and that are based on some sort of data and mathematical formulas. Some optimization approaches are intended to optimize yield on perishable products (like a seat on a flight soon to depart). Others are intended to optimize contribution margin. Still others are designed to balance both upside profit potential, with downside risk of losing business.

Previously only found in certain verticals with massive amounts of transactional data like airlines and hospitality or retail and fast-moving consumer goods, price optimization is now becoming the new norm for progressive companies in B2B industries like process manufacturing, industrial & high-tech manufacturing, wholesale distribution, professional and business services, transportation & logistics, and many more. Traditionally, the impetus for taking advantage of price segmentation and optimization approaches has been a financial one. We will explore this first, and then note 3 key implications for customer experience as well.

The Financial Case for Price Optimization

Most of these progressive companies have begun to leverage more advanced pricing capabilities for their ability to drive incredible profit gains (10%-30% gains in operating profit) and subsequent returns on investment (projects with measurable ROIs of 500%-800%). The reason for the strong benefits results is simple: a very small improvement in realized price translates into a very large increase in operating income. Because the gains in realized price carry no incremental costs like COGS or additional overhead, all the gains in revenue go straight to operating income.

Various management consulting firms have noted for years that – when considering a typical Global 1200 company – a 1% improvement in realized price typically translates into a 10-12% gain in operating profit. This impact is significantly greater than any other profit lever such as variable costs, fixed costs, or sales volumes. Deloitte published a study in the Journal of Professional Pricing that noted – across over 100 pricing projects spanning 5 years – an average benefit of 3.2% in realized price, which would translate into an average 32% increase in operating profit. As one price optimization software client – a Fortune 50 company – noted at their user conference, “How can you afford NOT to invest in this capability?”

Customer Segmentation is the Key to Price Optimization

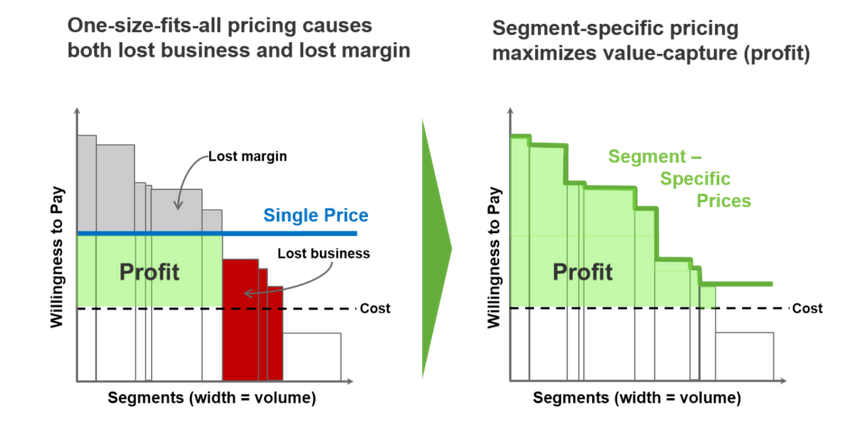

Where does the increase in realized price come from? Is it as simple as just raising prices? No, of course it’s not that simple. The basis – especially in B2B industries – comes from being able to discern, measure, and then leverage how different customers value your products differently. For example, one product can be sold into several different markets, or end-use applications. The customers in those different markets or applications perceive value differently, and therefore have a different willingness-to-pay. These clusters of customers and products are essentially pricing segments that can be treated differently to maximize value capture for the organization. However, if your sales and marketing department has a single list price or target selling price for that product, you are limiting the potential revenue (and margin) you could be capturing.

One of the keys to this approach is developing a good understanding of these segments and how they behave with respect to pricing. As computing power continues to get faster and cheaper, modern price software tools have now made this kind of analysis and segmentation possible whether there are terabytes of data to utilize, or very sparse data.

Improved Customer Experience

While the financial rationale is usually the primary reason companies invest in capabilities around pricing segmentation and optimization, what is often overlooked is that these capabilities properly applied can also improve your customer experience(s). There are at least three ways pricing optimization can help improve the customer experience.

- Accurate pricing from the start. As we’ve noted above, different customers have different value perceptions and therefore levels of willingness-to-pay. By fine-tuning your offer (including pricing of course) to each segment, you’re tuning in to a more suitable and appropriate offer for each customer interaction. When a salesperson offers a price that is based not on some broad-brush approach to the market or gut feel, but based rather on similar customer/product/channel situations, the price will be more accurate from the beginning. This reduces the friction in the sales or negotiation process as you’re starting out at a more accurate price to begin with.

- More efficient quoting process. By leveraging modern tools and processes for price optimization, the quoting process for customers becomes a lot more efficient. The optimal price is determined in nearly real-time, and can be returned to the salesperson and customer just as fast. This price – being already supported by data and sound strategy – doesn’t then need a long string of approvals, speeding up the quoting process. A large high-tech OEM organization implemented such Configure Price Quote (CPQ) capabilities combined with intelligent / optimized pricing and saw dramatic improvements in the speed with which they could return price quotes to their customers. This improvement in the customer experience translated into a dramatic increase in this company’s win-rate for their quotes. The customers were voting with their pocketbooks that they approved of the optimized pricing (and more efficient process) as well.

Read: What is Intelligent CPQ and Why Should You Care?

- Data-driven prices. When approaches like pricing segmentation and optimization are utilized, the sales team or price negotiators have a reliable – and logical – set of supporting data to help them sell more confidently. If a customer questions the validity of a price (even if for purely negotiating purposes), the salesperson has a set of rational peer-deal examples available to support his offer. This adds some logic and reason to the pricing discussion vs. old-school haggling and brinksmanship.

The case for pricing optimization is clear and strong, and while it has traditionally been for financial reasons (increases in revenue and profitability), some companies are also finding that when they invest in upleveling their pricing capabilities, they are also seeing significant improvements in customer experience as well.

If you’re considering a price optimization solution, first download our whitepaper, 10 Tips For a More Successful Price Optimization Project.