Many companies have, to put it politely, a haphazard approach for setting customer prices. In spite of the best efforts of pricing process owners, what I often see when talking with companies about how they set prices is that sales runs the price-setting show.

There may be a rules-based discount structure, but rules are made to be broken. “We’ve got to offer this discount to maintain our business with this customer”. “We’ve got to use this price to meet comp”. The list goes on and on. Usually, there’s some sort of logic being used to differentiate prices given to one customer versus another – grouping them into ‘segments’. But it’s often tough to discern the logic.

Defining Segments and Segmentation

Whenever I’m discussing options for taking control of the pricing process with pricing professionals, the topic of segmentation always comes up. Just about every B-to-B business uses some sort of segmentation in its price-setting process. Depending on who I’m talking with I’ll hear different definitions for the term, almost as many as I hear when everyone’s favorite pricing term – optimization – is on the table for discussion.

So, what exactly is a segment, and what’s the definition of the term segmentation? Simple questions that don’t have simple answers.

At a basic level, the definition of pricing segmentation is the process for charging different prices for the same or similar products. For many companies, ‘segments’ are defined as groups of customers. Salespeople understand this concept. Biggest, best, those with most potential business…groupings that reflect how important customers are to the business, with pricing strategies designed to reflect that importance.

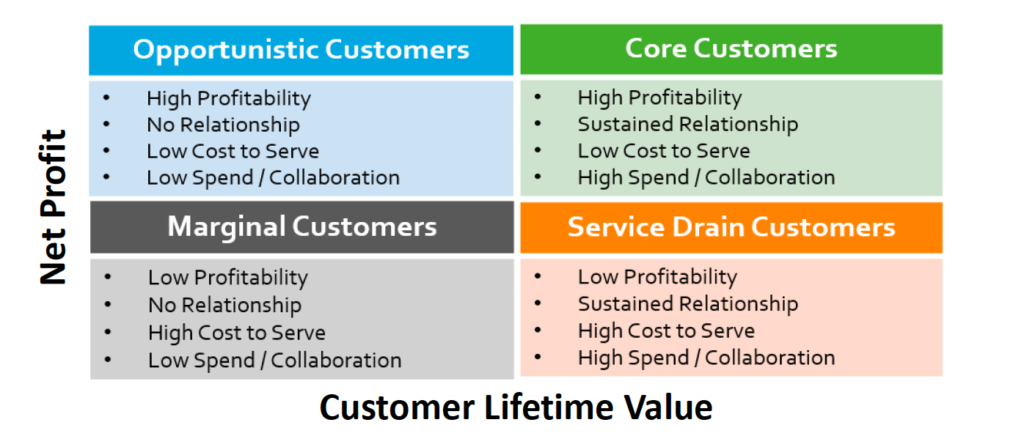

A simple starter method to set up this type of segmentation could be to do an ABC stratification of your customers based on sales – customers that do the most business get the best prices. Taking it to the next level you could apply a more sophisticated matrix approach that takes additional factors into account. Something like this:

Once customers have been categorized, you could apply different discount levels to each group in the matrix. The approach can be further extended by constructing a similar matrix for products. Say four segments of customers intersecting with four segments of products, now we’re up to a sixteen-box matrix – much more granular than a simple ABC approach.

Taking an AI-optimized Pricing Approach

What I’ve been describing above is a form of business segmentation. Segments defined by business logic and rules. What a business logic-based approach doesn’t do is take the realities of willingness to pay into account. Here’s an example of what I’m getting at.

Say you’re a distributor of pumps and pump parts. You’ve got two different customers, Customer A and Customer B. They’re both in the same industry, do about the same amount of business, are in the same region, and are what you’ve defined as Core Customers. If you’re using a business segmentation approach, odds are they’re going to be in the same customer segment and be quoted the same discounted price on pumps.

What won’t be readily apparent – and reflected in the price with a business segmentation approach – is that Customer A always shops around for pumps and consistently negotiates for a lower price, versus Customer B that doesn’t. It’s there in the data, but the business segmentation approach isn’t fully data-driven.

The approach used by Vendavo’s Deal Price Optimizer is different. Our AI-optimized pricing segmentation methodology uses customer and product attributes that may be used in a business segmentation but leverages those characteristics against the reality shown in historic transaction data. With Vendavo’s AI-optimized pricing approach, segments aren’t just groups of customers or groups of products. They consist of customer/product combinations. If one customer has demonstrated high price sensitivity for a product versus a similar customer, each customer/product combination will end up in different segments and be given different pricing guidance.

Different definitions for the same term. So what’s in it for you if you move from business segmentation to AI-optimized segmentation with Vendavo’s Deal Price Optimizer? Data-driven pricing that’s based on a customer’s willingness to pay, resulting in higher revenue and profits, and potentially happier salespeople as they win more and more profitable business.