Is the United States headed for a recession, or worse, stagflation? Although the future is tough to predict, many signs are pointing to continued economic distress. Here’s how to future-proof your business and survive potential prolonged inflation coupled with a recession.

On June 14th, the Bureau of Labor Statistics reported that the Producer Price Index (PPI) has increased 10.8 percent for the 12 months ended in May. Much of the increase was attributed to the price of fuel, but few parts of the economy were left unscathed. Even services, which are not necessarily subject to the same supply chain bottlenecks that have hamstrung manufacturers and distributors, saw an increase of 7.6% on an annual basis.

Producer Price Index has increased 10.8% for the 12 months ended in May

In the first quarter of 2022, GDP was down 1.5%

The National Bureau of Economic Research (NBER) defines a recession as, “a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” Are we there yet? Possibly. In the first quarter of 2022, GDP was down 1.5%. Reasonably so, all eyes will be on the Bureau of Economic Analysis when second quarter GDP numbers are released in September.

The Federal Reserve is in a precarious position. Its dual mandate includes pursuing the economic goals of maximum employment and price stability. The tried-and-true method of raising interest rates to tame inflation will likely push the US economy into recession, assuming it isn’t already there. When interest rates were raised to up to 21% by Paul Volcker and The Fed in the late 70s and early 80s, inflation was brought to heel at the costs of high unemployment (sometimes double digits) and a weakening dollar. The alternative to reigning in inflation is to let it run amok and push essentials like food, shelter, and utilities out of reach. Smart money expects at least a 0.75% increase in the interest rate. On Wednesday, June 15th, The Fed pushed through a 0.75% interest rate increase to stem the tide of inflation. Time will tell if this is enough, or if we should gird for a painful bear market.

The combination of high, persistent inflation, sluggish economic growth, plus the thread of increasing unemployment raises the specter of stagflation. Whether this comes to pass or not, the days of easy money and growth-at-all-costs are behind us. Prudent businesses will take this opportunity to reassess current practices, tighten the belt on cost, and focus on profitability over hollow growth. Specifically, what can you do to lead this charge?

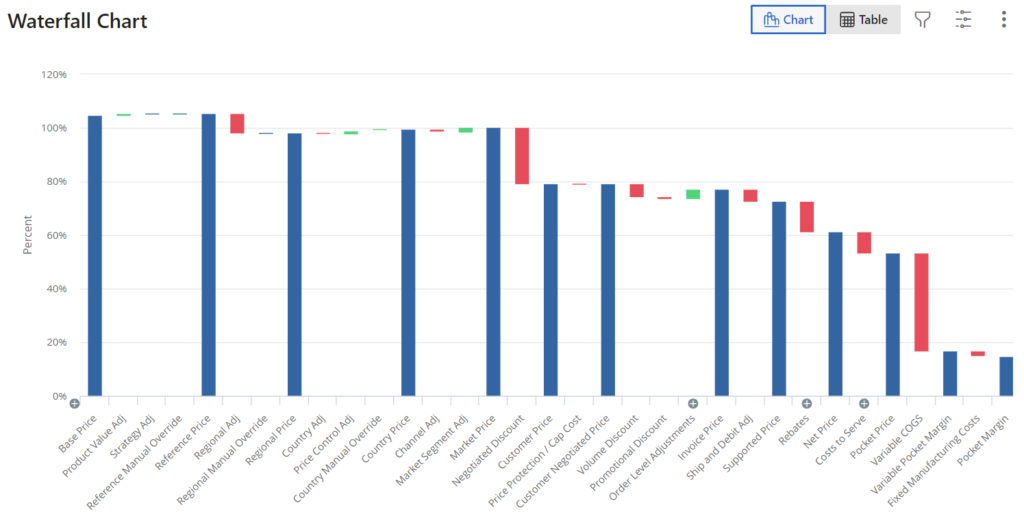

Use The Price Waterfall to Plug Margin Leakage

Every dollar of margin is precious in a tough economy. You cannot afford to give away unearned discounts, offer ineffective promotions, or sell marginal products to unprofitable customers during a recession. It is time to truly understand where your margin comes from.

Use the Price Waterfall to get line of sight to all puts and takes between Base Price, Net Price, and all the way down to Pocket Margin. From there, develop a remediation plan for unprofitable sectors of the business. This could include raising the market price of a particular set of products, clamping down on off-invoice adjustments for channels that aren’t delivering profitability, or working with specific customers to renegotiate Customer Specific Pricing.

The first step in any Margin Leakage remediation is to understand where there is a problem. Vendavo offers two ways to quickly assess where your dollars are falling out.

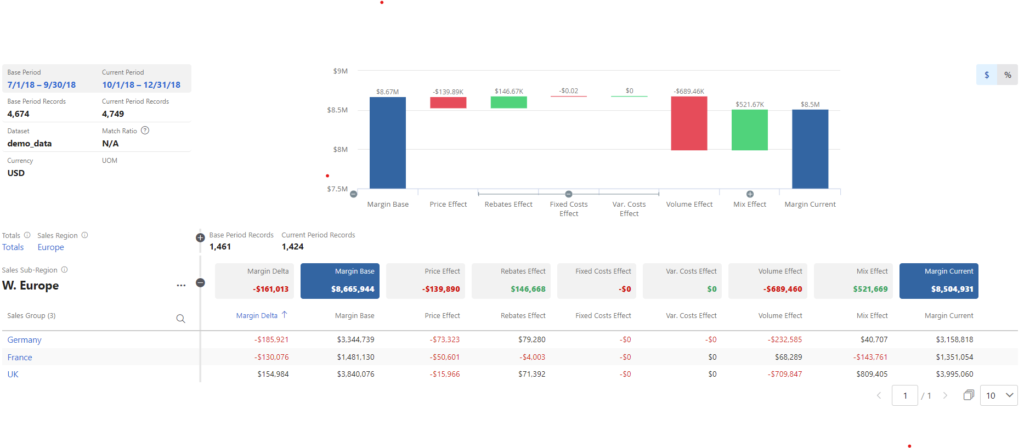

Make Complex Analysis Simple with Margin Bridge Analyzer

Margin Bridge Analyzer is an advanced Price, Volume, Mix modeling solution that helps users find insights into the drivers of revenue and margin change. These insights can quickly be configured for different parts of the organization, from finance to sales, to product management and production. A frequent quick win is to understand the all-too-frequent situation where you’ve agreed to price decreases but have not seen enough new volume or a positive shift in product mix to make up for the hit in margin.

Identify Margin, Price, and Profit Opportunities with Profit Analyzer

Profit Analyzer is a descriptive and diagnostic analytics solution for sales and pricing teams. Its playbooks, culled from years of Vendavo pricing experience, will walk users through structured analysis and insights to find pockets of profitability that you otherwise would have missed. Leverage leading-edge SaaS with out-of-the-box best practices for pricing and profitability.

None of us can predict exactly what the future holds. But change is the greatest certainty. The best thing you can do is prepare your organization for anything that might come your way: prolonged inflation, supply chain issues, global crises, or a recession, to name a few disruptors. Vendavo is committed to helping manufacturers and distributors weather the storm. On your journey toward unlocking revenue and profitability, we’re with you every step of the way.