Even in today’s volatile economic landscape, Aftermarket services deliver higher margins. And price improvement equates to greater profitability. But as discovered in the 4th Annual 2022 Aftermarket Benchmark Study by Copperberg and Vendavo, more manufacturers failed to realize the revenue and profits that a robust Aftermarket services business can deliver than in the last 4 years.

While the reasons why vary, where the missteps occurred are clear. When it comes to managing a strong Aftermarket business, digital transformation plays a critical role in powering a successful program. Over the last 4 years, progress was made in digital transformation but it either wasn’t enough, or more likely, it hadn’t yet been applied to the Aftermarket portion of the business.

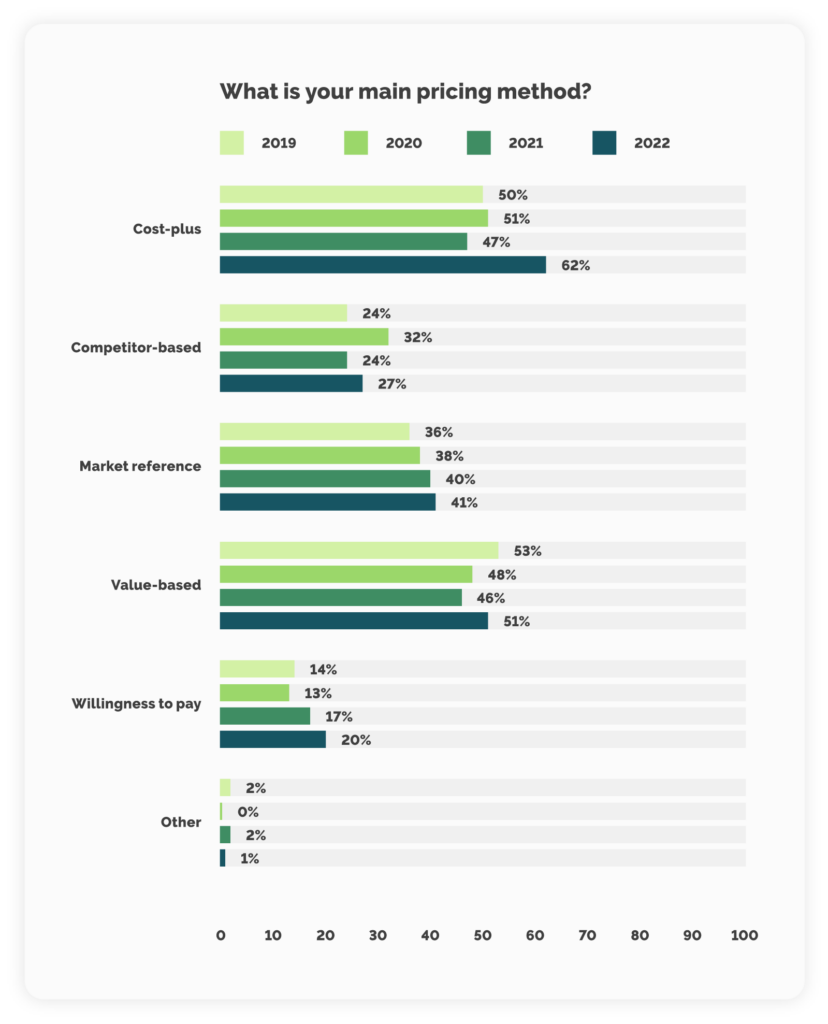

Resurgence in cost-plus pricing

Another contributing factor to lower revenue and profit realizations within an Aftermarket business is a lack of price optimization. Most respondents (62%) to the 2022 study indicated they rely on a simple cost-plus (blanket mark-up) pricing strategy. This is up from just 50% in each of the prior three years. Although the cost-plus model seems like a safe and secure comfort zone for many, it can become expensive and result in a major loss of profit over time.

Market turmoil driven by inflation and supply chain disruption is likely the cause in the increased number of manufacturers utilizing this pricing model. While at some level, it’s reasonable to see more manufacturers revert to cost-plus pricing methods, it’s short-term thinking. Research has consistently shown cost-plus pricing does not lead to greater gains in the long run.

Value-based pricing

Value-based pricing, and with it a solid understanding of customer value drivers and an ability to communicate that value to the right customers, is where true profitability gains are made. The approach isn’t one you can turn on overnight, however. Most respondents to the Aftermarket Benchmark Study said value-based pricing is the goal, but it will take time to work toward.

The best place to start is with an understanding of value-based negotiation techniques and the options you have during uncertain times. Define your customer’s pain points and how the value provided by each of your services address these pain points. Remember to think about the next best alternative for your customer and each of your service offerings. This may bring risks, but it is crucial to determine the willingness to pay and have proper reasoning as to why the value of your offering has higher value and price.

Working with pricing experts and/or putting together a price management team will also help you better manage your pricing models, better understand what drives customer value, and better align your prices to the customer’s willingness to pay.

Alternative revenue boosters

To increase revenue in the immediate future, many manufacturers report they are also looking to new contracts. Some are looking to increase their revenue using subscription contract models (32%), followed by closing performance-based (15%) and outcome-based (12%) deals. These tactics have been gaining traction over recent years because they create opportunities for scaling servitization and digital transformation while also allowing a degree of pricing flexibility that enables providers to set prices based on the unique needs of the customers.

To learn more about the current state of the service business and how the Aftermarket business can contribute to revenue and profit growth, download the Annual Aftermarket Benchmark Study.