Our recent webcast “Is REBATE a 4-letter Word?” with Will Humsi, Senior Director at Simon-Kutcher and Partners and Dave Anderson, Business Consultant at Vendavo was an extremely insightful discussion. Our attendees were from all industries – and the chat discussion was equally wide-ranging! Check out the Q&A below. How much money are you spending to gain absolutely no benefit? What are your partners really doing to help combined profitability? We’ve got the solutions to help you understand what is happening today, what you can do tomorrow, and what you need in the future.

Is REBATE a 4-Letter Word? 3 Ways to Regain Control of Channel Profitability with your Incentive Programs

CONDITIONS

Q – I get that incentives should be conditional – what are other examples of conditions?

A – Generally, they are revenue-related, or operational. Revenue related conditions are pretty straightforward. Examples of operational items might be carrying minimum inventory, or ordering with appropriate lead times, or meeting promotional requirements.

Q – What are ways to prove out the conditions – that the requirements are met?

A – Best practice – make sure you have clear, measurable KPIs – measured via transactional data. Items that require account manager verification is not ideal. Also, there are systems for tracking – even across wide range variations of format and submission – Vendavo’s Rebate & Channel Manager is a great example…

MISTAKES

Q – So, 6 common mistakes here – which one is the most frequent / damaging?

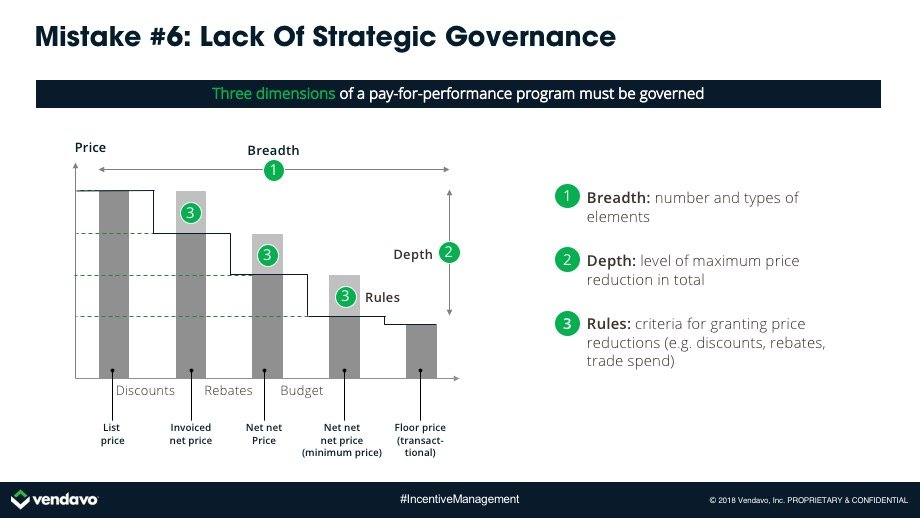

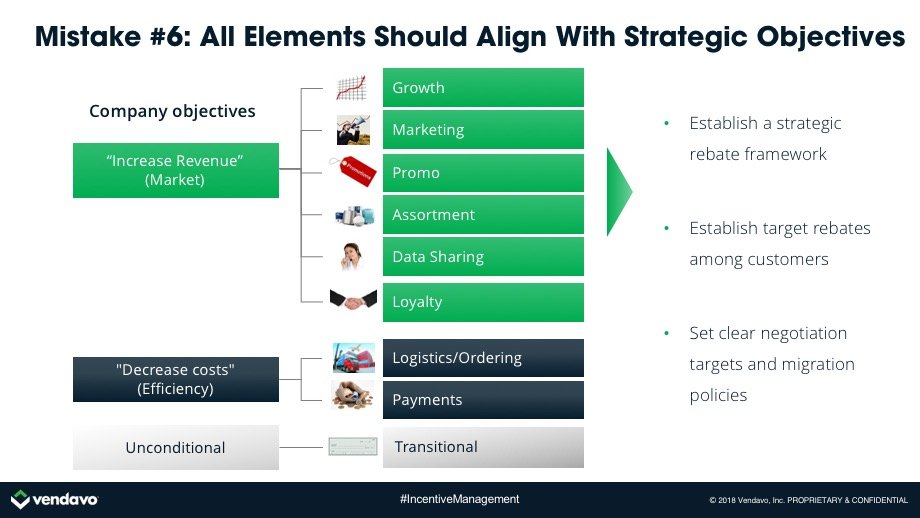

A – #6 – lack of strategic governance- almost the precursor for all the others – getting this right prevents a lot of headaches

Q – Here’s another question from the audience: “you’ve covered 6 mistakes – what’s number 7?”

A – There’s a lot to consider but, the #7 failure which is a common one, would have to be incentivizing volume growth versus profit growth through the channel. If you think about incentivizing units (volume), you are also incentivizing lower revenue and margin per unit. There are always three “optimal” price points. Volume optimal, revenue optimal and margin optimal. Volume optimal will always result in lower revenue/profit so any incentivize should be set in terms of dollars, not units.

Q – Does it matter how you set the condition (quantity vs. value) per strategic objective?

A – Absolutely. For each condition you must define “rules” which govern how and when a customer earns a rebate. The rules should support your objectives and they should be value-oriented. That is, we would like to see profit or revenue vs unit growth.

CRITICAL COMPONENTS

Q – So, I get the Channel data Management objectives – but I’ve got dozens of channel partners, with all different data protocols. How do I manage all the various data sources?

A – A proper Incentive Management platform will include channel data management capabilities, usually a portal for partners to submit data, ideally in their format, and capabilities to transform and normalize the data for use in validation, reconciliation, and payment

Q – How would you go about moving distributors and possibly current customers from set pricing to a rebate program?

A – Will is speaking right now, but I’ll relate a bit of my experience. I used to run a polymer business unit – we had a small set of very large customers. We started with the largest customer, and explained the situation: “we want to give you a special deal but we don’t want everyone to know it” – that usually got them very interested. It was easy to work down the list of “low price” customers with that approach.

During a break in speaking, Will adds: A few tips. First, you want to establish your common objectives and test that they are acceptable to your customer. Next, you need a gradual transition so you don’t implement a large change in one year. Third, the program should allow them more upside if they overperform how they are doing today. Show them they can do better under a new program! You’ll also want to model out their past year’s performance and show them that net-net they will be kept whole, granted they don’t underperform.

Q – Our company has very little to no current rebates. Our concern is creating a lot of admin work that is not there today. Are there cases where maintaining no rebate programs makes sense?

A – As pricing becomes more transparent – price masking gains greater value. I used to run a polymer business – a small set of very large customers had VERY good deals. We used rebates to reduce transparency in the market – and avoid unnecessary downward pricing pressure.

Will adds: Rebates also tend to make sense when there is short-term variability in performance that is difficult to predict. The ultimate key is that you do not treat all customers the same and reward the customers that perform according to your objectives. If you can do this all on-invoice without rebates, that’s great. But rebates give you the extra security that you are only paying on performance because they come after the fact. The ultimately balance is how much control do you want over your customer price differentiation versus investing in admin to support off-invoice

15% BENEFIT

Q – So, there are a couple of comments/questions – expressing some incredulity: “Wait – what? 15% benefit? On what basis?”

A – The simple answer: Yes – we routinely see 15% of general incentive programs being spent unnecessarily – paying when the performance requirements were not met, or because of clerical errors, or where payment thresholds are too high – everything below the threshold being paid out. The ROI on efforts like this are very strong. And it only takes a short time to bring those benefits to the bottom line.

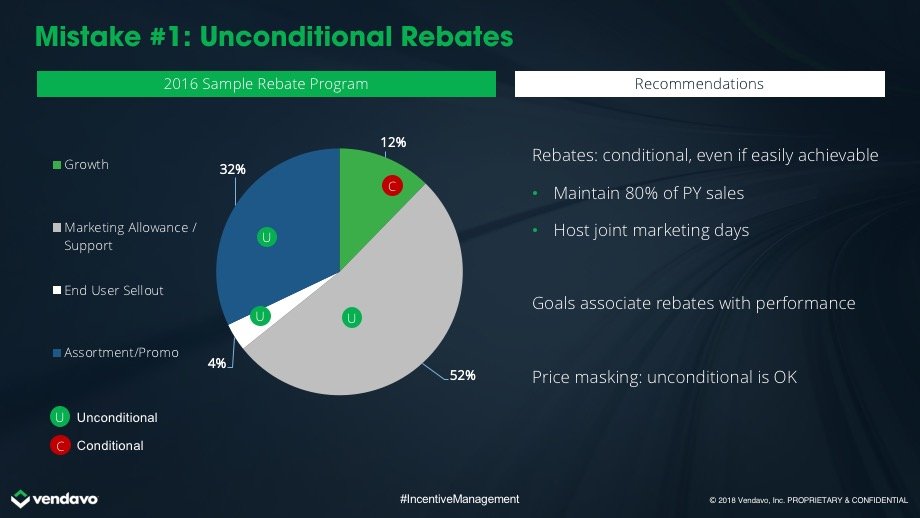

Q1 – This one is to Will – and it references one of the common mistakes you discussed – the first one I believe: If roughly 90% of today’s rebates and incentives are unconditional (I’m pretty sure that’s close to the number in my company) how I shift towards having more that are conditional – performance based?

A1 – paraphrased – please reference recording […measurement and sizing the prize is a great place to start – need agreement and prioritization from a lot people, you have to show how big the benefits are relative to everything else currently on their plates…]

Q2 – There are a couple questions hear that are similar / I’ll consolidate – they are speaking to benefits, and roles:

And I’ll ask Dave this one: So, there’s a lot of benefit that would be appreciated – especially in the effort required for the folks that payout – in my company, that’s the finance folks. What are the benefits for the sale reps?

A2 – paraphrased – please reference recording […reps knowing that they are offering appropriate incentives, greater customer satisfaction, and fewer firefighting efforts around validation of incentive payouts. and ultimately – more sales with customers that are “sticky”…]

Q3 – Here’s a question that comes to my mind as I’m looking at the chat activity – are there different strategies and tactics that vary across industry vertical – practices that are unique or very useful in one vertical that don’t really apply in others?

Will, I’ll point this one to you: A3 – paraphrased – please reference recording […look for things that would be differentiating for you in your industry…]

Q4 – This looks like it will be our last question, and it’s for Dave. In your discussion of the critical capabilities for incentive management, you laid out 3 general areas of focus: program design, automated compliance, and payment processing. You stepped thru them in order, which obviously makes sense if you are starting fresh, with a blank sheet and no prior or existing incentives. My company has a lot of issues (opportunities!) in all three areas – where should I start working on fixing problems – what is typical low-hanging fruit to gain acceptance, and what are areas where I can gain big benefits to get the effort prioritized?